Why Choose The Home Loan Expert?

Great Customer Service

Our customer-first approach to mortgages is what separates us from the competition. We’ll walk you through all your options and provide expert guidance at every step, ensuring that your loan closes as quickly and smoothly as possible.

We Are

the Experts

Our Loan Officers have decades of combined experience in the mortgage industry. We hire only the top-producing and most talented loan officers in the nation (because you deserve the best!).

Better Home Loans, Lower Rates

Because of the volume of loans our team closes and the great relationships we’ve built, we’re able to offer the most competitive interest rates and the newest programs. Our loan officers all live within the communities they serve—meaning you’ll get the resources of a big-time lender with the service you’d expect from a local!

We Take Care of our Customers

Our customer-centered process has been streamlined from start to finish.

Our ability to use the newest mortgage loan products and underwrite our own files allows us to approve loans that our competitors can’t.

| Why not the best of both worlds? | The Home Loan Expert |

Mortgage Brokers | Big Banks |

|---|---|---|---|

| Unlimited loan programs |  |

|

|

| Lower rates |  |

|

|

| Entire mortgage process under one roof |  |

|

|

| Local Loan Officers guiding you every step |  |

|

|

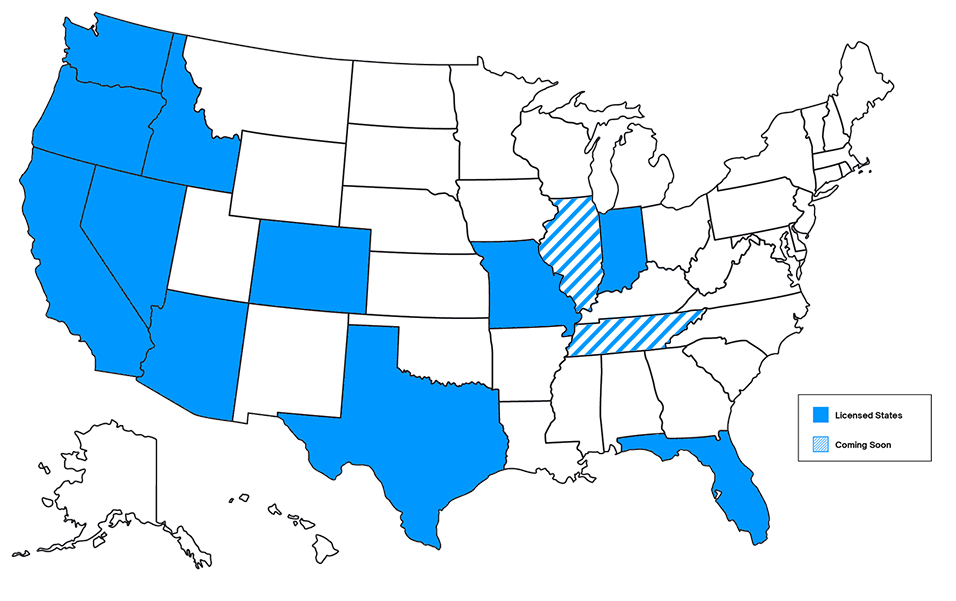

One of the fastest growing lending platforms in the nation

Operating locally in 11 states and counting!

We give back to our Community

Providing great loans is what we do—but giving back is what we’re about.

2021 was a big year for us. We established Keep Climbing Foundation, a nonprofit raising funds and awareness for children’s and veterans’ causes.

We care deeply about the communities we serve, and we hope to keep growing our impact each year. Click the button below to learn more about our impact.